Why technology has failed to disrupt insurance

Billions invested. Hundreds of get started-ups. Lots of hype. The strategy that the hundreds of years-aged coverage marketplace is ripe for disruption by new technologies has been pulling in investors and business people for years.

It is quick to see why they have been casting envious glances toward coverage — it is significant, can generate respectable revenue, and has been accomplishing small business in broadly the similar way for a long time. By sprinkling in some AI, some big info and some person-welcoming applications, went the argument, it must be attainable to win a good slice of the marketplace.

A lot of individuals acquired into the concept. According to details from insurance company Gallagher Re, much more than $40bn has been invested in so-termed insurtech commence-ups globally in excess of the earlier five a long time.

And but buyer insurance remains largely undisrupted. The largest motor insurers in the United kingdom, for case in point, are the exact types that were close to a 10 years or two back — Aviva, Admiral, Immediate Line et al. It is a comparable story in the US. And the real motor and house insurance policies we all buy is also minimal modified. Yes, we might buy from a rate comparison web site somewhat than a high street broker, but the policy itself is broadly the exact same as it employed to be.

Distinction that with the revolutions that have taken location in retailing, travel, and plenty of other industries.

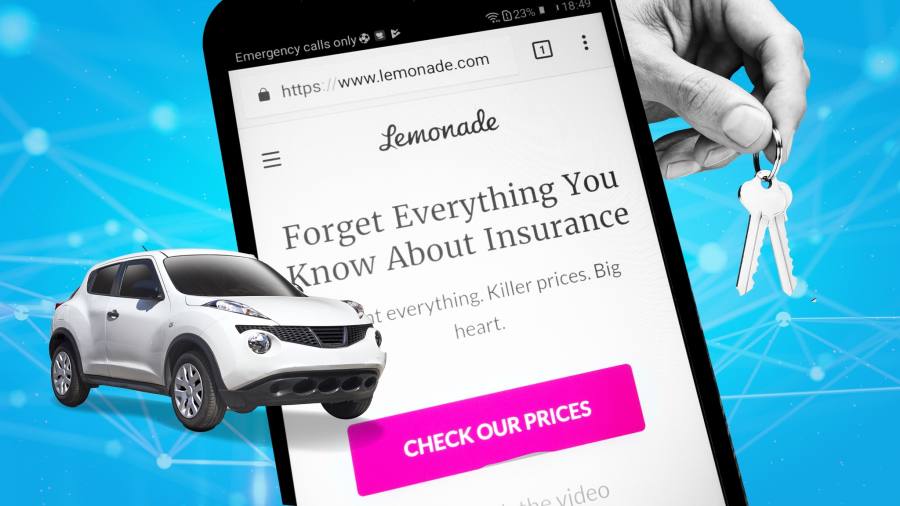

The wave of start off-ups have struggled, so considerably, to make a major splash. US-stated Lemonade, just one of the greatest-profile insurtech start off-ups, is however lossmaking and is forecast to continue to be so this year and next. Its share cost has sunk by 59 for every cent about the past yr. Other US listed insurtechs this sort of as Hippo and Root have fared tiny improved.

In the British isles, businesses these kinds of as By Miles (fork out by the mile motor vehicle insurance plan) and Cuvva (short term motor vehicle insurance policy) have good strategies and are escalating but have so much hardly produced a dent in the £16bn motor insurance policy sector.

A person huge difficulty these begin-ups confront is that it is difficult to get individuals interested. “The customers just never care enough about their insurance plan,” claims Paul De’Ath at consultancy Oxbow Partners. “You have a very aggressive sector the place the vast majority of shoppers are focused on cost. They care fewer about the attributes.” Remarkable the general public about the most recent Apple iphone innovation is a single issue. Thrilling them about the latest insurance innovation is a much even bigger challenge.

And so the start off-ups have had to contend with the major operators on price tag. Lemonade was launched in the British isles past year. Its site tells a story. Just after telling website visitors to “forget almost everything you know about insurance”, the subsequent line claims “keep your stuff safe from £4/month.” The clarification of how its insurance policies get the job done and the superior brings about it aims to aid come considerably reduce down.

They also have to do the job hard to win company. That suggests lots of highly-priced internet marketing, both by direct advertising and marketing or by operating as a result of value comparison web-sites. Phrase of mouth will only go so significantly in insurance coverage.

And, argues Rob Moffat at undertaking cash group Balderton, they have to get far better at working with claims by weeding out fraud and retaining repair expenses down. If these expenditures blow out, no amount of money of wise facts or novel business versions will hold the small business in the black. Even incumbent insurers find this tricky — Immediate Line on Wednesday warned on profits due to the fact of rising claims expenses.

It may possibly be tempting for the massive insurers to let on their own a small sigh of aid. The a great deal-feared wave of disruption has been smaller sized than many feared. And as the tech marketplace retrenches and funding results in being far more scarce, the prospect of a big, closely backed new entrant is receding.

But the risk is however there. Individuals not often like insurance plan, so there is even now scope for an individual to come in with an offering that will improve their minds. And looming on the horizon are the massive tech groups. Though none of them has built a big drive into the sector so significantly, they have been nibbling at the edges. Amazon is the most current, with a prepare to start an insurance portal in the United kingdom. Individuals envious glances have not absent away.

:quality(70)/d1hfln2sfez66z.cloudfront.net/02-02-2023/t_832fc9813d3741189856dfd7da126358_name_Car_Insurance_Increase_transfer_frame_627.jpeg)